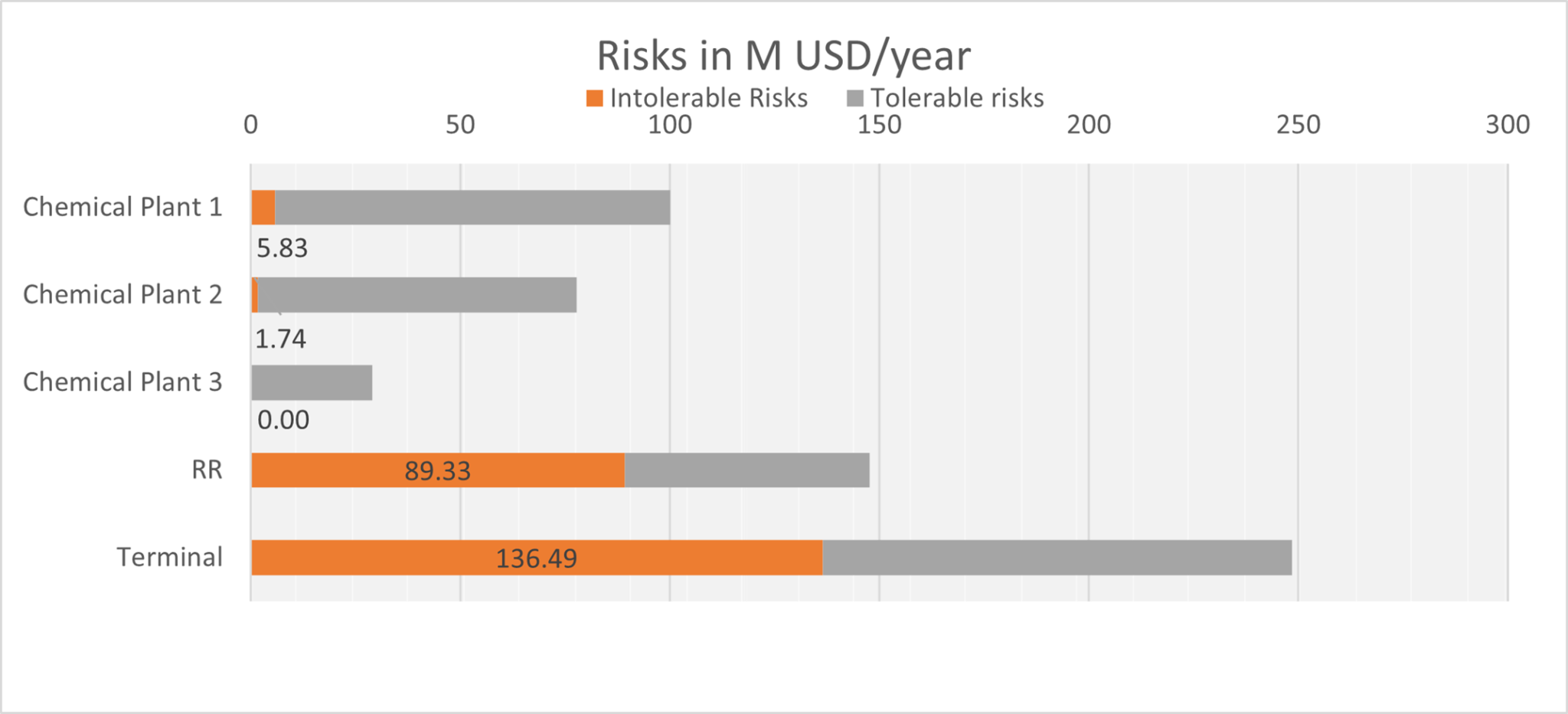

From this graph we can see that the RR and Terminal generate a greater portion of intolerable risk than the chemical plants do. This may appear as obvious given RR and Terminal represent a bottle-neck, but it is quantified and just the start of a series of cascading queries useful for planners.

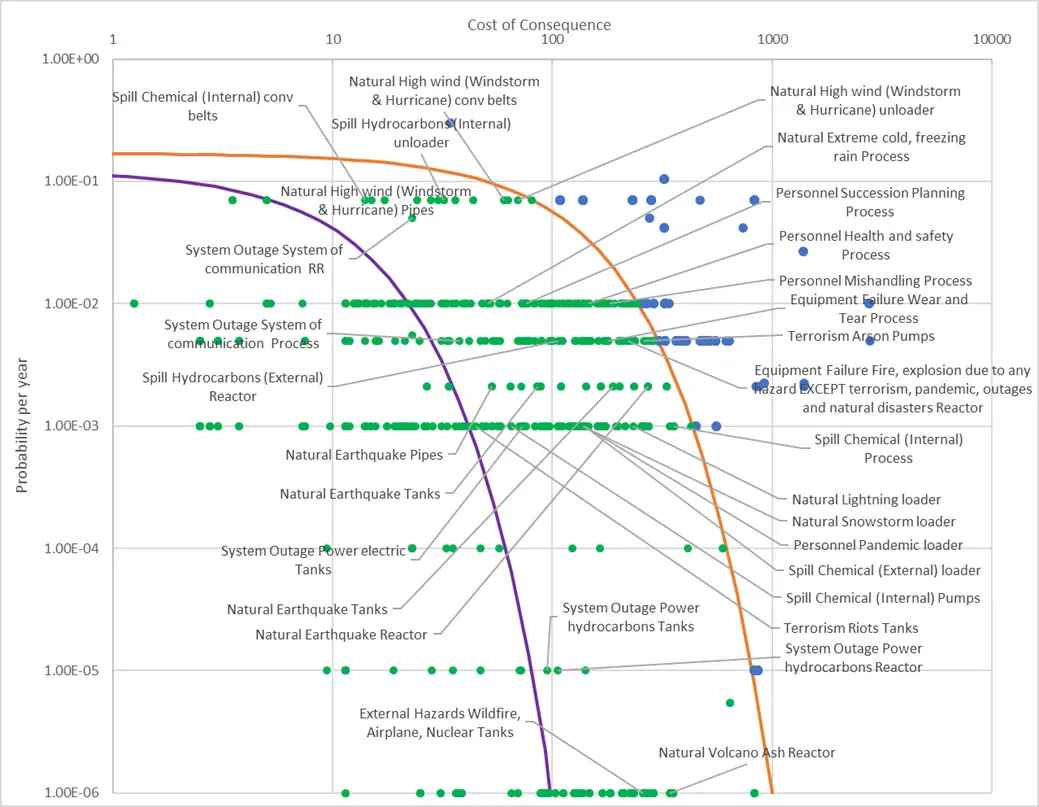

Indeed, using the built-in granularity, we can then zoom into the risk register to show the intolerable risk per sub-elements within the operations. This allows to evaluate the best possible mitigative tactics and strategic moves as applicable. As a matter of fact, the Chapter then goes on discussing different scenarios allowing the decision makers to focus their attention in a Risk Informed Decision Making approach. The scenarios include:

- climate change divergence

- cyber divergence and

- others could be added

Thus it is possible to optimize the size of say, buffer stocks, based on risks arising from climate change, or quakes, or hurricanes. Insurance coverages can also be optimized. This results in the implementation of innovative Force Majeure clauses with built-in B2B preventative solutions.

Closing remarks on risk tolerance

A convergent quantitative risk assessment should empower decision makers with answers about different aspects of the risks. For instance, which risks are tolerable, intolerable but manageable, and intolerable and unmanageable. Risk tolerance for tactical and strategic planning is a reality. We use it on a day-to-day basis and is affordable.

Defining tolerance thresholds makes it possible to provide a transparent definition of what constitutes a manageable risk. For instance, if mitigative investments and risk transfer can bring a risk below tolerance then that risk is manageable. Of course economic sustainability has to be considered in the selection of the means.

Intolerable risks for an operational manager may differ from Corporate. However, thanks to the risk tolerance which makes these differences clear, discussions can take place in a more serene communication environment.

The roadmap for mitigating an operation’s risks, expressed as relative value of the intolerable risks, helps maximize the time and resources of managers. That is by focusing on the most important issues and not necessarily on immediate issues. Indeed, this is the ultimate goal of Risk Informed Decision Making.

Glossary

Please refer to the freely downloadable glossary (here). If used please reference to it as, "Riskope 2021 Technical Risk Engineering Glossary".