Optimum Risk Estimate deployments generally include quantitative convergent business interruption risk profiles. These are based both on “as usual” and divergent scenarios. These risk profiles allow for tactical and strategic corporate planning while facing risks such as climatic uncertainties.

Our scenarios often include hazards that clients consider “far-fetched,” and indeed, the domino effect in those cases may seem beyond possibility. Additionally, there is often a low understanding of the likelihood of a hazard when quantified as 1/100 or 1/1000.

As an example, we performed a quantitative risk prioritization of a large company with over 40 operations. Our assessment indicated that logistics impairment (ingress/egress) due to natural hazards ranked within the top five intolerable risks for that company. This was proven to be correct when fires, snowstorms, and flooding occurred.

Examples like this are the motivation behind:

- our last book Convergent Leadership-Divergent Exposures Climate Change, Resilience, Vulnerabilities, and Ethics

- an article at CIM 2021 titled Concentrate Transportation From Mine to Market is Critical to Mines’ Profitability

Atmospheric River and Quantitative Risk Assessment

Recently, British Columbia was affected by an atmospheric river that caused massive damages to highways, railroads and dikes. Interestingly, our publications above cited case studies that closely apply to the damage caused by the atmospheric river. We demonstrated the characterization of the “new normal” and extreme events.

In addition, we showed how quantitative risk assessments allow a better understanding of the risk landscape to better form a mitigative roadmap. As a result, risk-based buffers, optimized force majeure contractual clauses and rational insurance coverage decisions become a reachable goal for any organization.

Furthermore, the importance of the explicit integration of interdependencies and uncertainties was demonstrated using real-life examples. These reiterated the need to break informational silos hindering balanced approaches. For example, looking at hazard categories in isolation, such as cybersecurity, natural hazards, and human acts of like sabotage or terrorism is misleading and leads to wasted mitigative funds. Companies and governments need convergent approaches for a sustainable, rational and profitable operation.

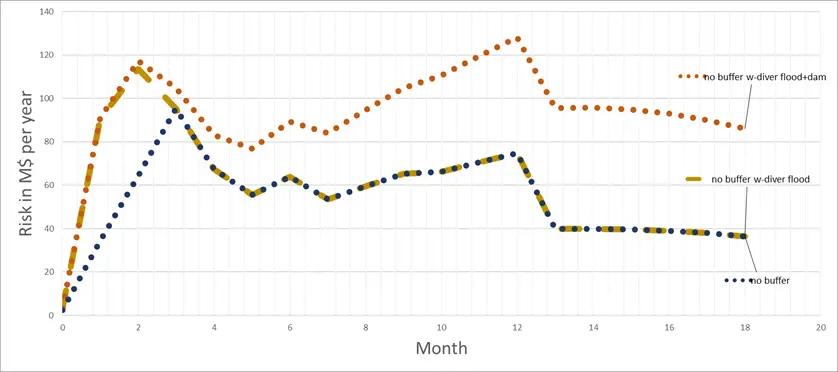

In the published case studies, we compared business interruption risk profiles for a railroad leading to a shipping terminal in three different cases with no buffer at the terminal:

- base case with “business as usual” hazards

- divergent flooding

- compounded divergent flood and dams effects

In the figure below, we see the corresponding business interruption risk profiles. The base case (blue dotted line) is displayed for comparison with the other profiles. The divergent flood alone (yellow line) and compounded flood and dam effects (orange line) diverge from the base case. The dams flooding significantly alters the risk profile towards the longest business interruption durations.