The topic of convergent, quantitative Enterprise Risk Management (ERM) on divergent risks is an extension of our recent discussion on business interruption risk profiles.

The example below is also referenced in:

- our book Convergent Leadership-Divergent Exposures Climate Change, Resilience, Vulnerabilities, and Ethics

- our article at CIM 2021 titled Concentrate Transportation From Mine to Market is Critical to Mines’ Profitability

Setting the Scene

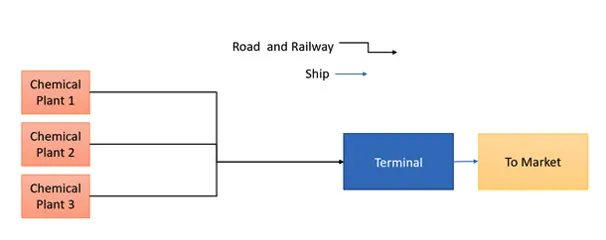

Suppose a corporation that owns and operates three chemical plants sends their products to a shipping terminal.

The company is interested in a convergent quantitative risk assessment to allow for risk-informed decision-making. This will enable tactical and strategic planning of their operations, rational and sustainable mitigation and corporate value building.

The figure below shows the ERM system definition.

Inclusion of Divergent Scenario with Different Mitigation Strategies

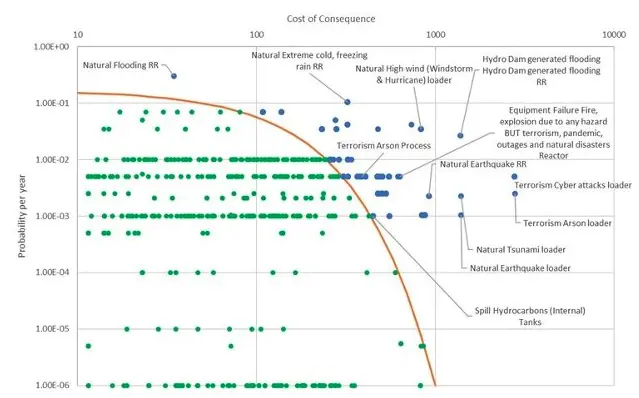

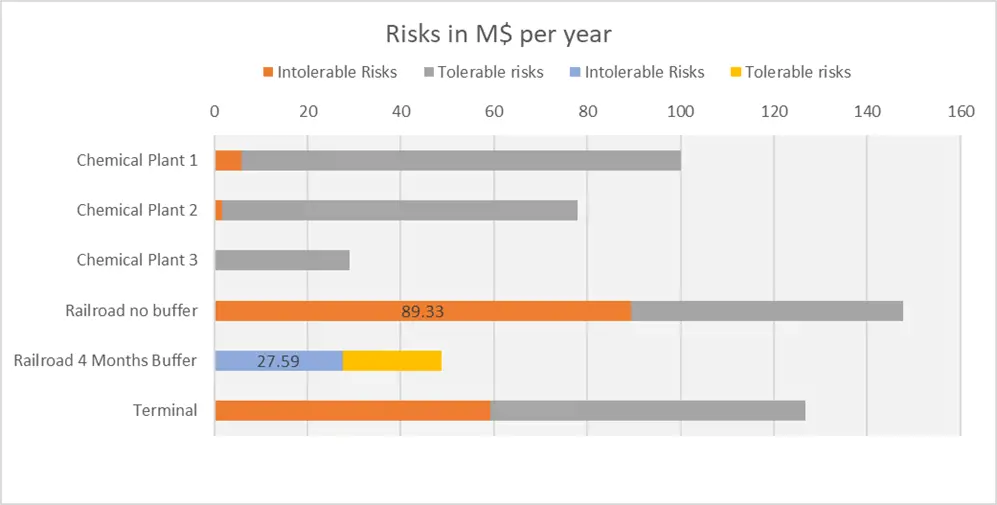

The figure below displays a p-C graph with selected risks and corporate tolerance towards that risk. The blue dots will be the object of risk-informed decision-making: they are intolerable risks, either tactically or strategically.

We can convergently look at intolerable risks per element, such as each operation, railroad and terminal. We will start with the assumption that no buffer is present at terminal as in the prior blogpost.

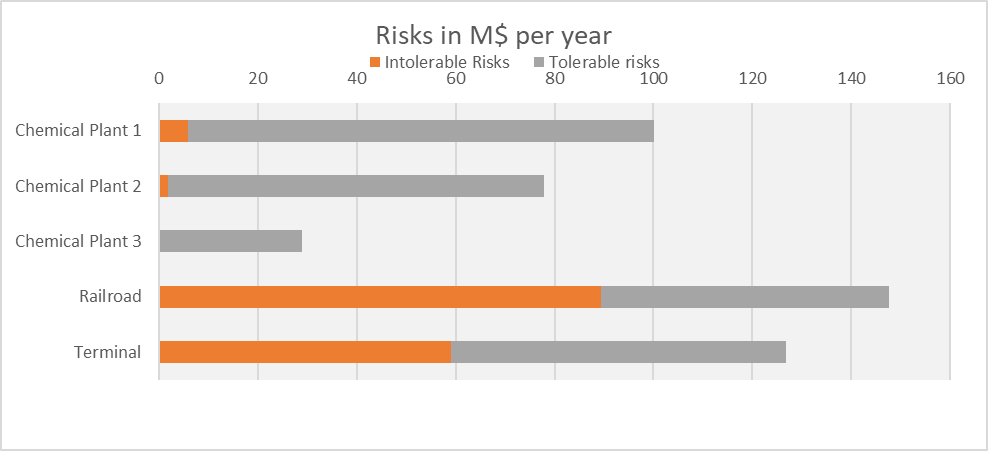

From the figure above, we can see that the railroad and terminal generate a greater intolerable risk portion than the operations.

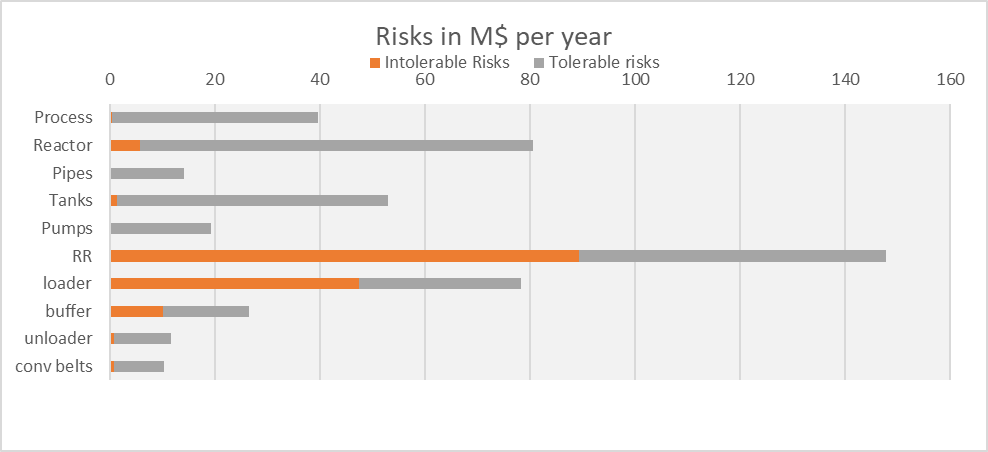

Using the built-in granularity, we can dive even deeper, showing the intolerable risk per sub-element within the operations.

Buffer Size as a Mitigation Strategy

The previous figure shows that a buffer in the terminal is necessary, since it would mitigate the railroad risks.

If the company was to implement a four-month buffer, the system’s risks would change as shown below.

The four-month buffer reduces the railroad’s intolerable risks by three times ($27.59M vs $89.33M), and changes the corporate risk prioritization of the entire system.

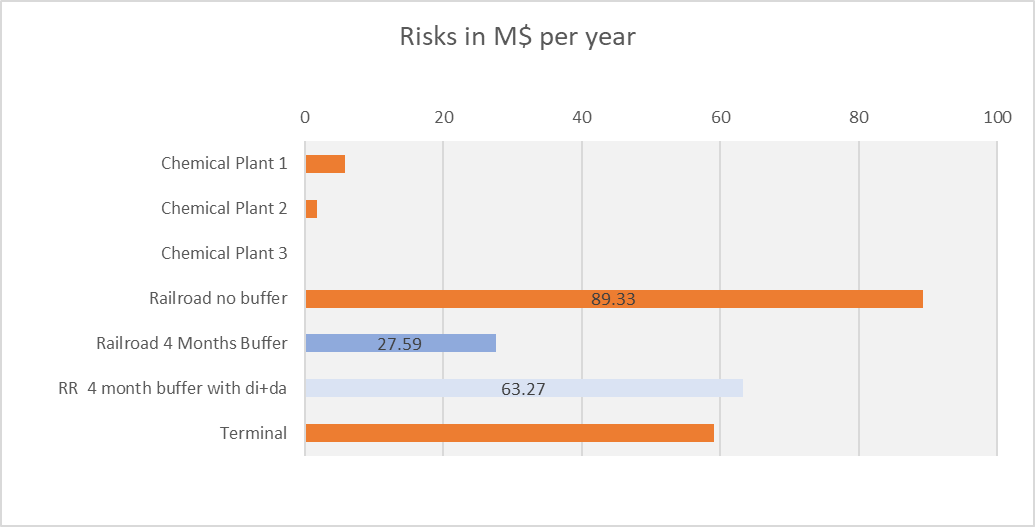

Climate Change Divergence

The figure below shows that despite the implementation of the buffer, climate change divergence (flooding and dams (di+da)) would still impact the railroad’s intolerable risks at the corporate level. As a result, the railroad risk would raise to $63.27M with (di+da) divergence vs. $27.59M without divergence.

The implementation of a four-month buffer at the terminal still significantly reduces the railroad risks; even with divergence, the risks remain lower than with no buffer and “as usual” conditions. As a result, railroad risks are comparable to those of the terminal.

Conclusion of Convergent Quantitative Entreprise Risk Management on Divergent Risks

As we saw, reduced resilience and susceptibility to systemic risks can become not only more common and intense, but can also propagate even more risk due to cascading probabilities and amplification of consequences.

Convergent quantitative ERM on divergent risks adds value to a company, project or venture, as it allows for strategic planning of corporate operations, rational and sustainable mitigation and sufficient insurance coverage.

This type of deployment allows companies to test “out of the box” mitigative alternatives, including in some cases B2B solutions, which help with potential force majeure disputes.