"We are not aware of any factors (environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors) that have materially affected the mineral resource estimate."

How many mineral resource statements have similar wording? With increasing global recognition of the importance of environmental, social and governance (ESG), such statements are no longer sufficient. A recent roundtable of Committee for Mineral Reserves International Reporting Standards members and advisors concluded that historical disclosure of ESG factors has been weak. Several reporting code committees are looking to revise their codes and/or provide further guidance on how ESG factors should be reported to improve public confidence and address investor expectations. This will build on the stronger ESG requirements contained in the latest CRIRSCO guidance (2019).

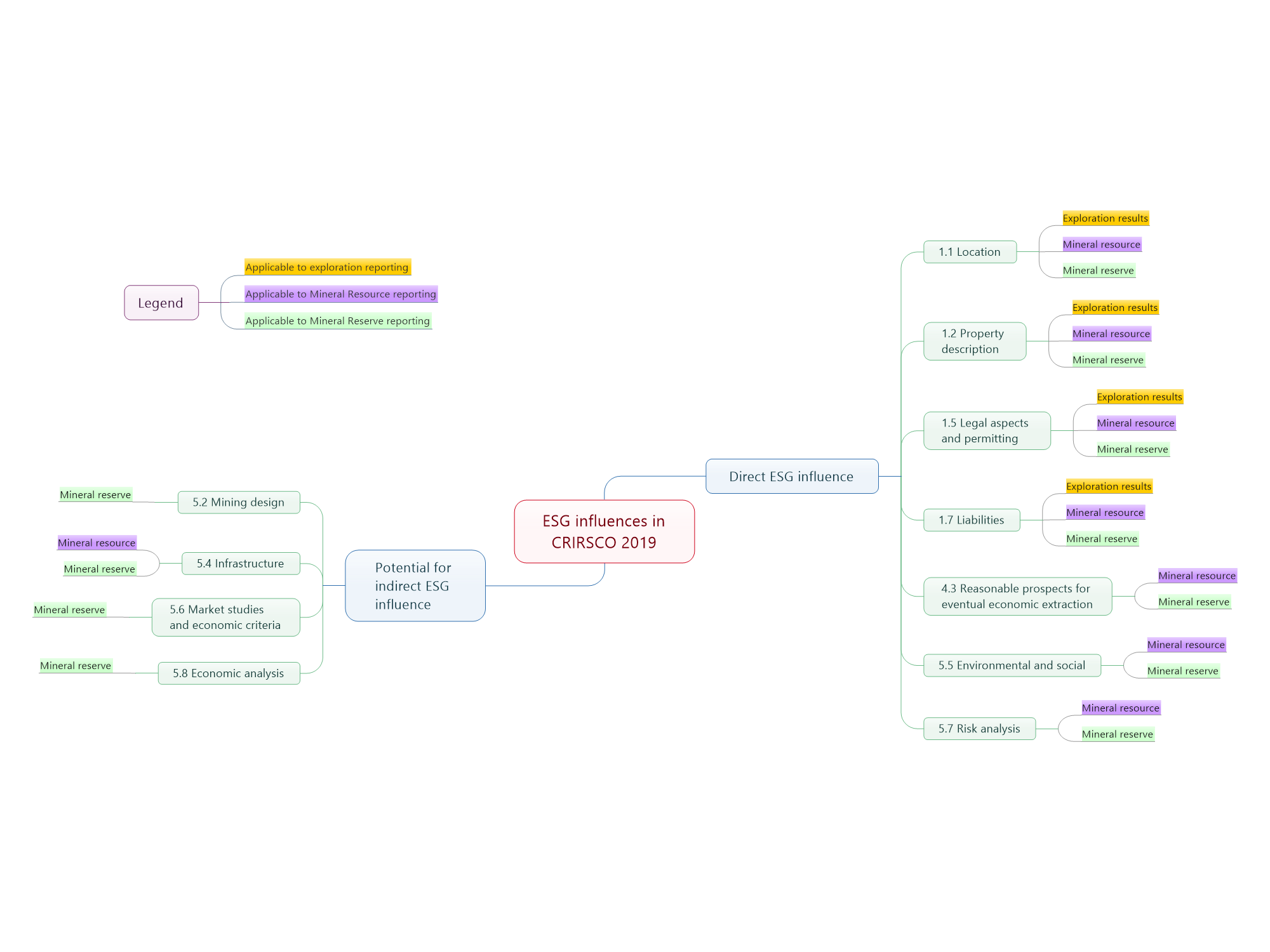

CRIRSCO 2019 includes a clear recognition of the trend towards stronger corporate governance, tighter government regulation, and increased demands from investors

and supply chain for transparency and disclosure on potentially material ESG risks. CRIRSCO’s Table 1’s Section 5.5 entitled ‘Environment and Social’ is new and many other sections include reporting requirements related directly or indirectly to ESG. Items like land access, property description and permitting clearly contain an

ESG component. However, ESG considerations also arise when mine design needs to incorporate closure requirements, where ESG factors constrain infrastructure location, and when the establishment of carbon taxes may influence economic analysis of the project.

Currently, the diagram above treats the level of disclosure for reporting ESG aspects for mineral resource and mineral reserves the same, though Chapter 12 indicates the assessment of impacts and associated mitigation measures should only be done for mineral reserves.

SRK recognises that ESG materiality for defining a mineral resource with ‘reasonable prospects for eventual economic extraction’ will be different to reporting a mineral reserve that is ‘economically mineable’. Assessing ESG factors in a mineral reserve estimation is easier than for mineral resource reporting, as information to identify ESG risks for mineral reserve reporting (at a prefeasibility study or feasibility study level) is more readily available. There is an expectation that ESG studies have commenced, permitting requirements are understood and engagement with local communities and other stakeholders is well underway. When reporting mineral resource, the ESG studies may only just be starting; however, ESG constraints still need to be highlighted and a statement made on how these will be addressed in the project development.

Mineral resource reporting is no longer solely the province of geologists. ESG professionals are needed early in the project development process to contextualise the ESG setting, identify potential modifying factors, ensure fair disclosure and advise on implications for future reporting of mineral reserves.