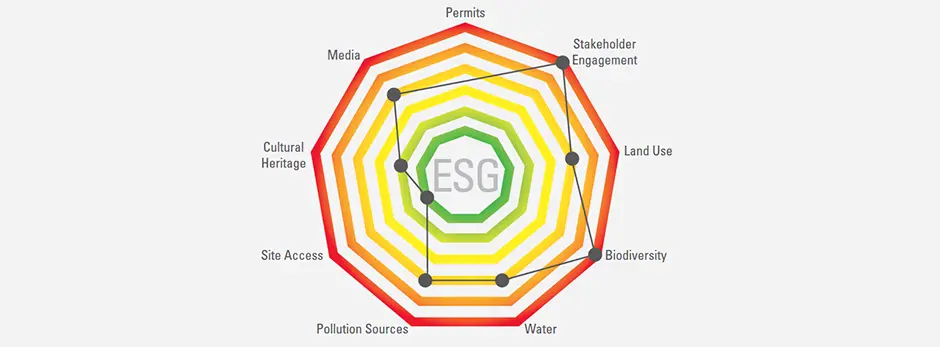

SRK is remotely supporting clients to gain a site-level snapshot of environment, social and governance (ESG) risks through the application of a desk based ESG Risk Review. This rapid and targeted assessment uses the site-specific ESG landscape as a lens to identify ESG risks for an asset that require the closest attention.

The continuing surge in interest in ESG aspects of company strategies and activities is requiring SRK’s clients to sharpen their focus on ESG matters, both for assets they own or those being targeting for investment or acquisition. In the current investment environment, the need to effectively share and act on ESG information has progressed from an optional extra to a core obligation.

The ESG Risk Review has already been applied to exploration projects and early stage project development studies where mobilising a full ESG team is impracticable. These quick assessments determined the likely site-specific ESG issues that will shape future project design and project development timelines. This in turn informed decision-making on where to most effectively invest time and resources. The output from the review adds value by communicating to potential financiers that ESG risks are understood and demonstrates a willingness to proactively manage and integrate these risks into project decisions.

The content of the ESG Risk Review is refined depending on the nature of the asset being reviewed and focuses on the areas of highest potential risk for the asset. The assessment can be done using only public domain information, for example for mergers and acquisitions where a potential acquirer wants to know if a more detailed ESG due diligence exercises is warranted before a deal is progressed further. When being done directly for the asset owner, it usually commences with a review of existing information provided by the client, supplemented by additional desktop research. SRK’s bespoke risk assessment methodology is then used to identify and rank the key risks. Strategic recommendations are provided for issues presenting the greatest risk to the project or operation and draw on SRK’s decades of experience in managing ESG risks in the mining sector.

_940x347px20200617080035735.webp)